tax shield formula uk

Net Income 8 million. Tax Shield is calculated as.

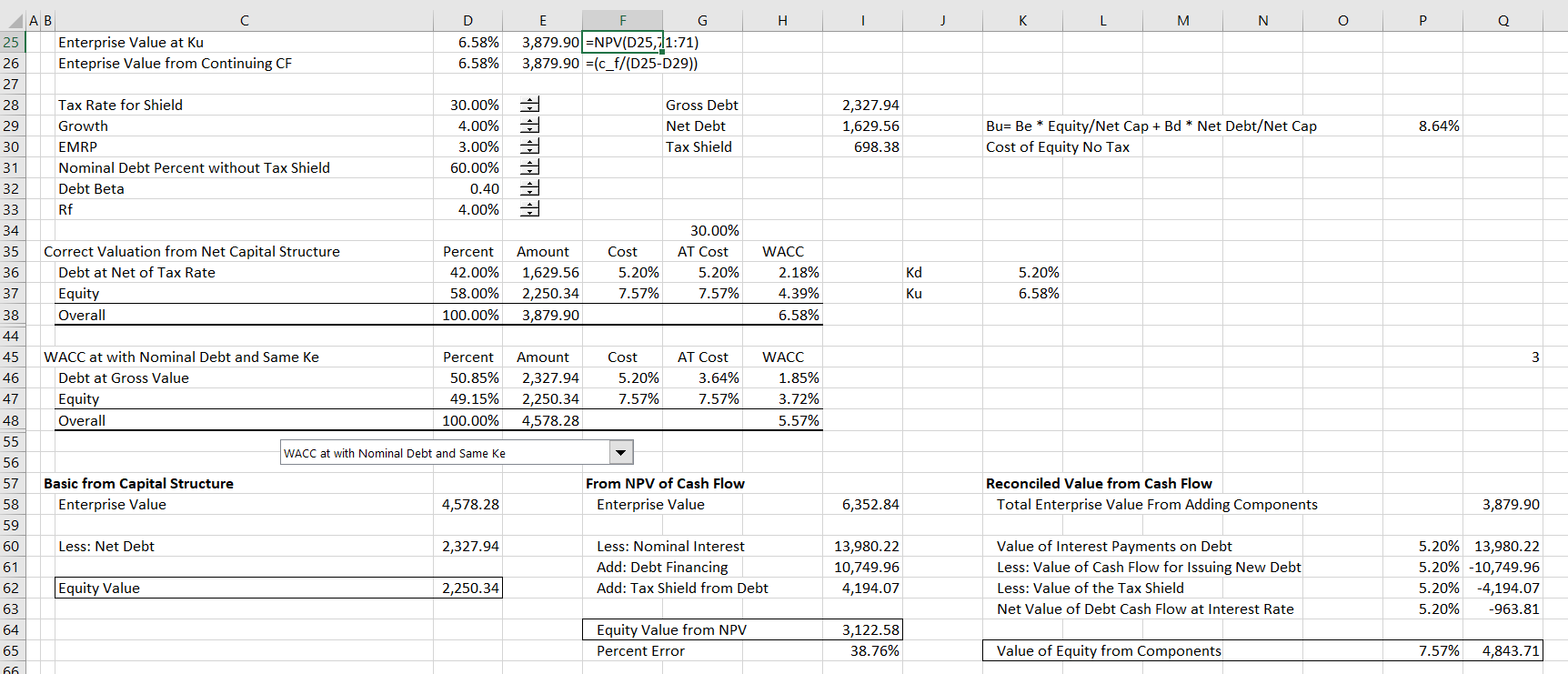

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

For instance if the tax rate is 210 and the.

. On the other hand if we take. Or the concept may be applicable but have less. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

You calculate depreciation tax shield by taking 100000 X 20 20000. Using the above examples. The tax shield Johnson Industries Inc.

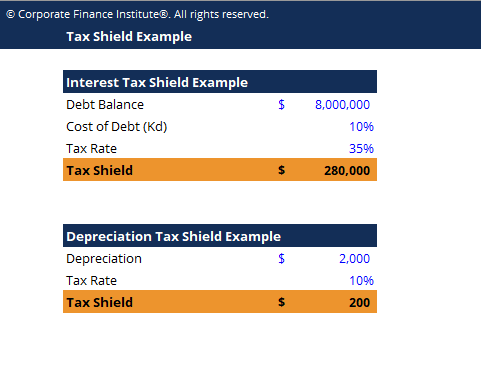

As such the shield is 8000000 x 10 x 35 280000. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35.

Assume Case A brings after-tax income of 80 per year forever. Tax shield calculated as. A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAI CE Investment Cost Marginal Rate of Income tax Rate of Capital.

The applicable tax rate is 37. The formula for calculating the interest tax shield is as follows. 600 expenditure 75.

Tax shield formula uk. Web To arrive at this number you can simply. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Interest Tax Shield Formula. The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts. Interest bearing debt x tax rate.

Web The formula for calculating the interest tax shield is as follows. 600 expenditure 10 estimated average CCA rate 25 tax rate 10 estimated CCA rate 10 Discount Factor 75. Tax Shield 5000 40000 10000 35.

Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. The intuition here is that the company has an 800000. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

Under this assumption the value of the tax shield is. This is equivalent to the 800000 interest expense multiplied by 35. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation.

Interest Tax Shield Interest Expense Tax Rate.

National Fiscal Policy Responses To The Energy Crisis

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Lutein Zeaxanthin Meso Zeaxanthin Eye Supplement Vision Defender Mac Shield Your Eyes Save Your Eyesight Vegan Vegetarian Antioxidant Carotenoids For Eyes 90 Capsules One A Day Made In Uk Amazon Com Au Health Household Personal Care

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

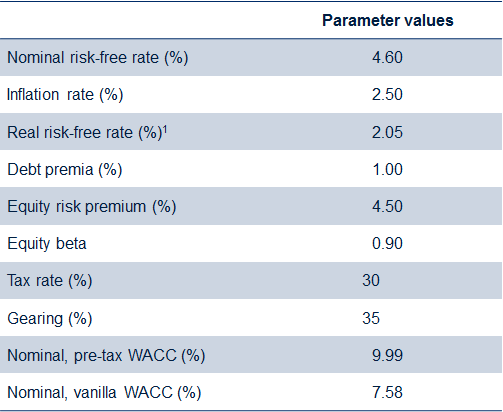

Which Wacc When A Cost Of Capital Puzzle Revisited Oxera

Tax Shield Calculator Efinancemanagement

Common Share Valuation Approaches Taxation

Pdf Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance

Basics Of Corporate Interest Restriction Understand The Cir Bdo

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Hycosan Shield Eye Drops Preservative Free Single Ingredient Formula For Management Of Dry Eye Symptoms 280 Applications 3ml Amazon Co Uk Health Personal Care

Pdf Tax Rate And Non Debt Tax Shield

Tax Shield Example Template Download Free Excel Template

Agreements On Beps 2 0 Provides Needed Breakthrough On The Future Of International Tax International Tax Review